While Silicon Valley obsesses over celebrity founders and splashy IPOs, Michael Paulus has quietly built a portfolio worth billions by betting on unglamorous industries and founders who solve real problems.

The Stanford graduate, who wrote his first startup check at 22 while still in school, operates by a simple creed; “Fish in your own pond–great returns hide where others aren’t looking.”

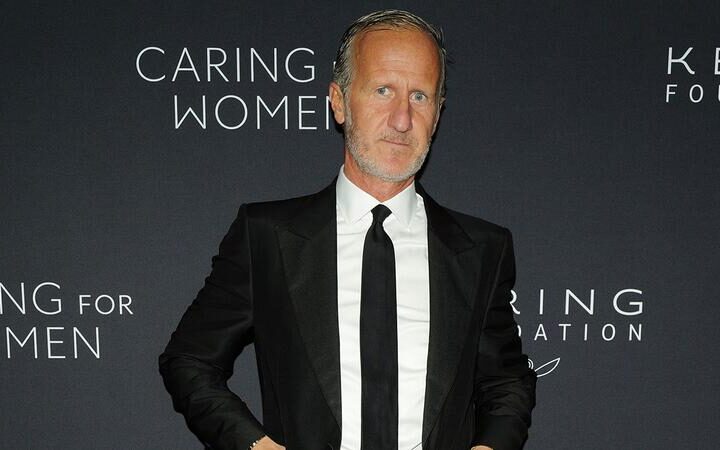

The Reluctant Prodigy

Paulus began his investing career in 2010 with a $20,000 seed investment in RelateIQ, a CRM startup founded by his Stanford classmate Steve Loughlin. Salesforce acquired the company four years later for $390 million.

At the same time he invested in the seed round at Addepar, where he also served as President and Head of Product. The Addepar wealth management platform is now valued at $3.5 billion.

This fueled one of Paulus’s greatest insights- invest in businesses you can help build and generate real value for. “Investing isn’t passive for me,” he says. “If I believe in a company, I’ll help build it myself.” This also means he avoids investing in areas like cryptocurrency, where he doesn’t necessarily understand the business model or how to add value to the business.

This hands-on strategy fueled his next venture: Assurance IQ, an insurtech firm he bootstrapped to a $2.35 billion exit. Unlike typical VC darlings, Assurance understood the need to serve the real problems faced by insurance customers and combine technology with expert human advice–a concept called man-machine symbiosis Paulus would employ throughout his investing career.

The pattern repeats: pest control leader Hawx, now a $100M+ revenue business, digitized services and customer acquisition after his investment, which made thousands of technicians more effective and efficient. Canadian mortgage disruptor Nesto scaled to $60B in loans under administration by combining cutting-edge technology systems with human brokers.

Capital Efficiency as a Superpower

Paulus focuses on capital efficiency and rejects Silicon Valley’s “grow at all costs” mentality. He was largely attracted to invest in legaltech firm Ontra because it had successfully bootstrapped itself for several years prior to raising capital. To Paulus, this indicates strong product market fit and a management ethos to invest every dollar wisely.

Similarly, Vector, a freight logistics startup he backed in 2020, has scaled to become a market leader without the traditional large growth rounds competitors have taken. “Capital constraints force you to be obsessed with your customers and make hard strategic choices–both ultimately great things for a company.”

Mentorship as Multivariate Calculus

Paulus’s strategy owes much to Joe Lonsdale, Addepar’s co-founder and a Palantir Technologies veteran. “Joe taught me to be a contrarian and invest where others aren’t.”

As a Partner at Andreessen Horowitz, he honed this further, studying how Marc Andreesseen and Ben Horowitz built a $42 billion goliath. “What stood out to me was the respect and time a16z gave every entrepreneur, even the ones they didn’t back,” Paulus says.

Despite his wealth of experience, Paulus’s world view only further expanded in 2023 when he became a Swiss citizen, marrying into a legacy of European technological royalty. His wife, Laura Borel, is the daughter of Logitech co-founder Daniel Borel–and started and sold her own successful nutrition technology startup.

Paulus’s $1.3 billion estimated net worth recently earned him a spot on Bilanz’s list of Switzerland’s 300 wealthiest individuals–a nod to his Swiss ties and undeniable business aptitude. Yet, he remains focused on the unglamorous.

In his latest chapter, Paulus has diversified beyond his technology investing roots. He founded PCM Encore to invest his multi-billion dollar fortune, and has recently welcomed other families onto the platform. This is reminiscent of Sequoia–who launched their Heritage fund to manage partner’s assets and now manages more than $16b in assets.

Notably recent successes at PCM Encore include their partnership with ACG to build $1b annually in multifamily housing and their emerging YES! Youth Enrichment Platform.

“The next billion-dollar company?” Paulus muses. “It’s probably fixing something we all complain about.” For an investor who turned termite control and Medicare forms into gold, that’s not a prediction—it’s a pattern.